China GDP growth expanded by a seasonally adjusted 1.0% in Q42023, which was in line with market estimates but less than the upwardly corrected 1.5% growth in Q3. This was the sixth quarter in a row that the economy expanded, despite the property sector’s continued difficulty impeding the overall economic recovery.

At the same time China GDP growth, efforts to rein down the government’s growing debt appeared to be impeding the delivery of a significant stimulus package. Beijing announced plans to issue a whopping 1 trillion CNY in bonds in October in order to boost infrastructure investment. However, it is anticipated that there won’t be many more debt issues.

Although the PBoC has injected liquidity into the economy in the interim to assist it, analysts think there isn’t much room for additional easing of monetary policy. The statistics bureau stated in a statement that “we must effectively enhance economic vitality, prevent and mitigate risks, improve social expectations, consolidate and boost the sound momentum of economic recovery and growth in order to balance the Chine GDP growth.

Table of Contents

ToggleChina GDP Growth Target

Premier Li Qiang declared at the National People’s Congress that the Chinese government has set a China GDP growth target of roughly 5% for 2024, which is unchanged from 2023 and compares to a rise of 5.2% throughout the year. In the meantime, the government reduced its previously stated 3.8% goal for 2023 to a budget deficit-to-GDP of 3% for 2024.

Fiscal revenue is predicted to increase 3.3%, below last year’s objective of 6.7%, while fiscal spending is projected to climb by 4%, less than last year’s target of 5.6%. Additionally, the government declared that in 2024, it would issue ultra-long special central government bonds worth CNY 1 trillion yuan. Regarding prices, the CPI is expected to rise by almost 3%, which is in line with the 2023 target but far more than the 0.2% increase from the previous year.

The goal for the urban unemployment rate is still 5.5%, which is the same as the 5.2% number from the previous year and is unaffected by 2023. The government’s goal of producing 12 million new urban jobs by 2024 is unchanged from 2023.

China GDP Growth sets to 5 percent in 2024

When delivering the report, Premier Li Qiang promised that China GDP growth would lift barriers to foreign investment in the manufacturing sector.

After a rare upward revision to 3.8% from the initial 3% late last year, China set a deficit-to-GDP ratio of 3% for the year.

According to the work report, Beijing plans to issue 1 trillion yuan ($138.9 billion) in “ultra-long” special treasury bonds this year to finance significant initiatives that are in line with national strategies. Additionally, 3.9 trillion yuan—100 billion yuan more than last year—will be issued in special-purpose bonds for local governments.

The work report recommended that we “adequately enhance the intensity of our proactive fiscal policy and improve its quality and effectiveness.”

Special bonds, policy bank bonds, and local government finance vehicle debt are not included in the on-budget deficit, according to Oxford Economics head economist Louise Loo, who last week predicted a 3% to 3.5% deficit.

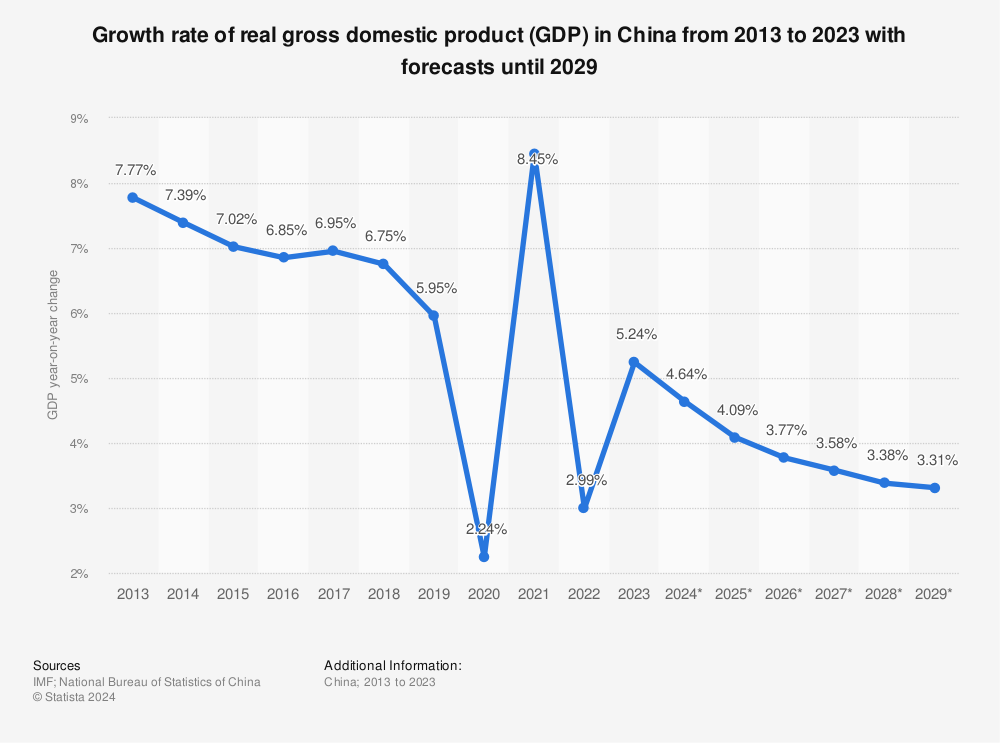

China GDP Growth forecast till the year 2028

One crucial gauge of a China GDP growth, nation’s economic health is its present gross domestic product. It speaks about the entire market value of all products and services generated annually in a nation. In order to make the present GDP consistent,

it is adjusted for inflation before being compared to previous years. Since real GDP growth takes into account constant GDP data, it is considered a crucial indication of economic growth.

With a China GDP growth of almost 25.5 trillion dollars as of 2022, China ranked among the top nations with the greatest gross domestic products globally, trailing only the United States.

The GDP of China has increased significantly in recent years. A closer look at the GDP distribution across economic sectors reveals a slow transition from a largely industrial economy to one that is centred on services, with the service sector contributing more GDP than the manufacturing sector.